Balance Transfer

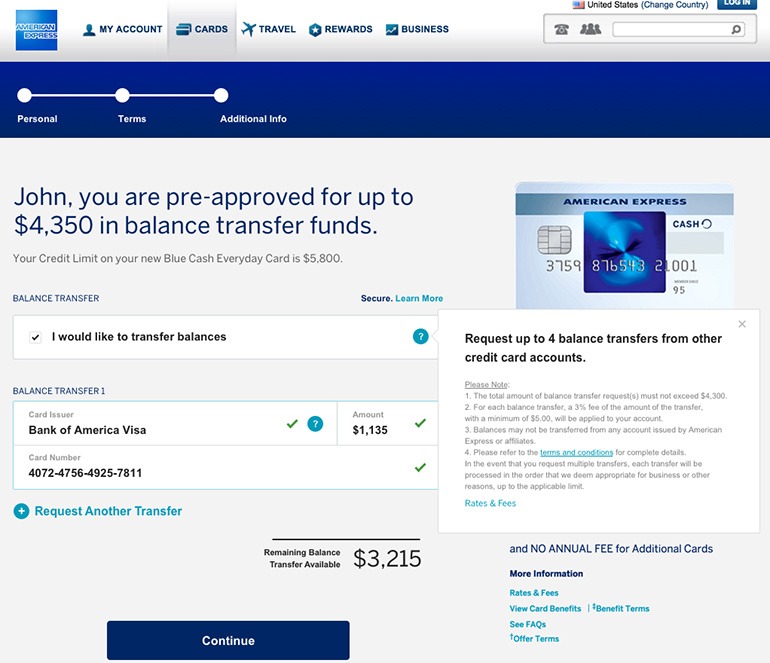

Transferring a balance from one credit card onto a new American Express card provides great benefits to the consumer. They have the opportunity to consolidate multiple cards into one; earn Membership Rewards® Points; and usually have an extended term with a small or zero interest rate.

- UX Design

- Visual Design

- User Research

- ClientAmerican Express

- DepartmentCPS Digital Acquisitions

- DateApril 4, 2016

The Problem

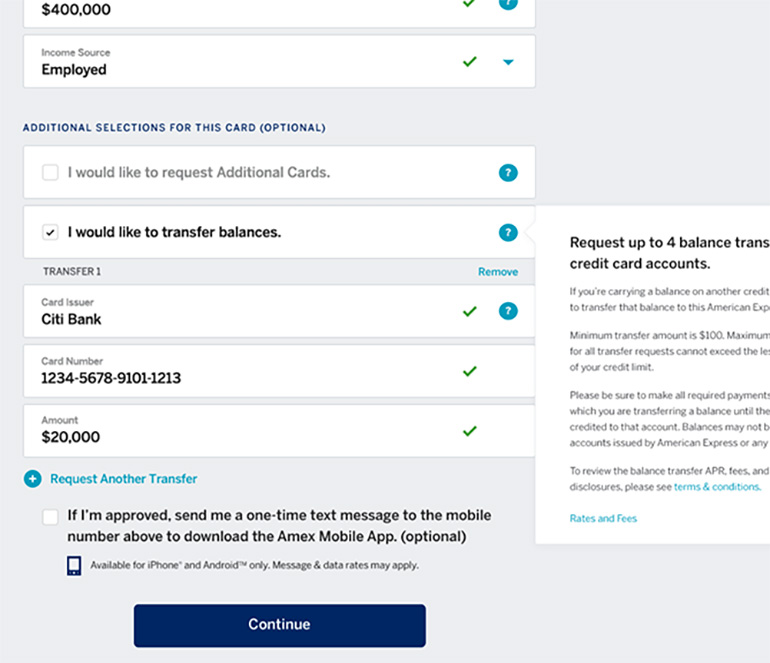

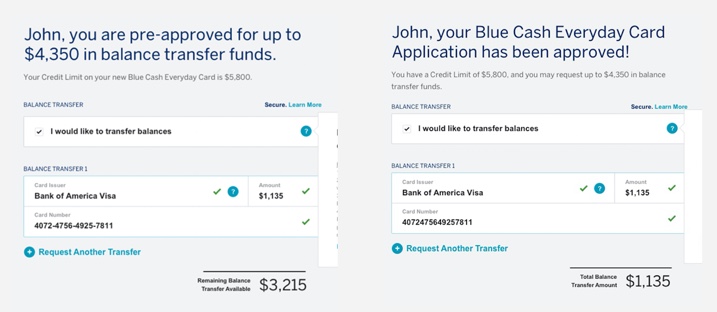

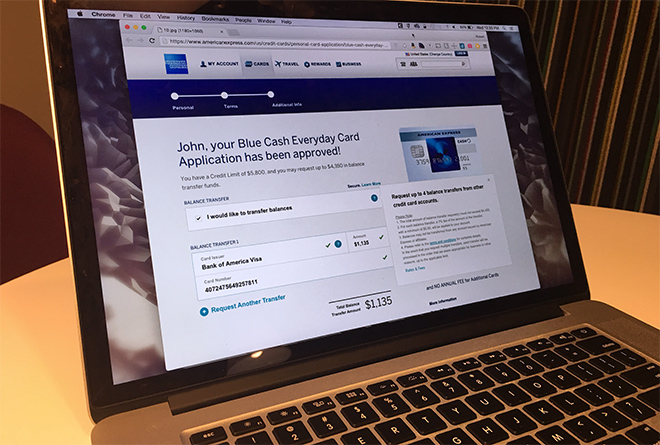

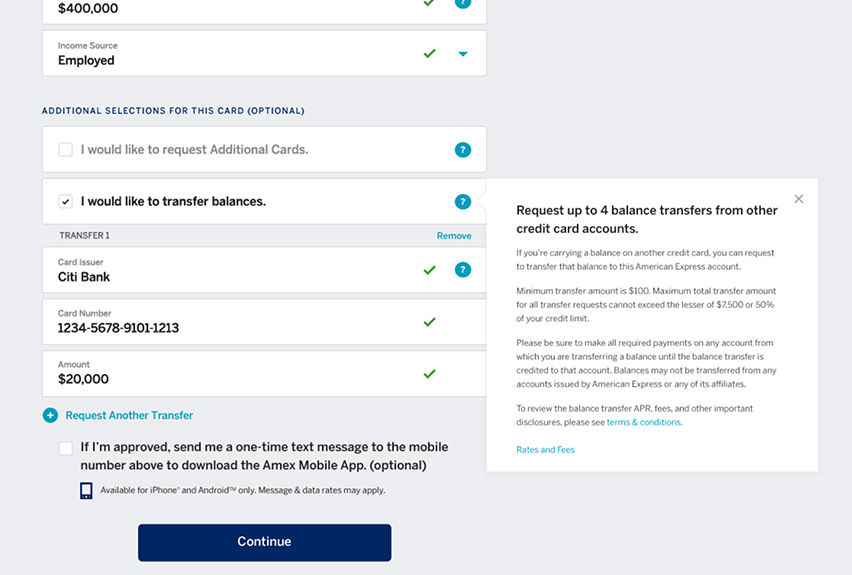

Prospects applying for a credit card are asked if they would like to include balance transfers in their application. The fine print reads, "Maximum total transfer amount for all transfer requests cannot exceed the lesser of $7,500 or 75% of your credit limit."

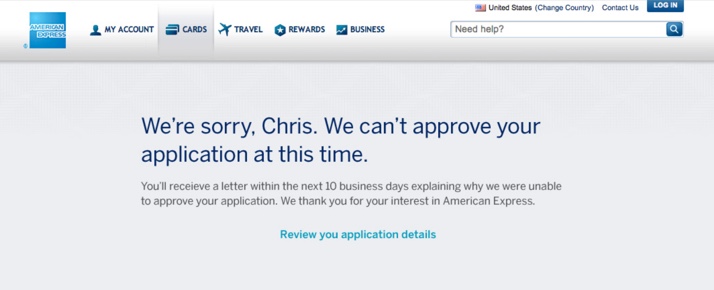

The issues with this are two fold: there is no client-side validation for the $7,500 amount; and prospects do not know their credit limit at this point. If they enter $5,000 in balance transfer funds, but the available amount ends up being $3,900 - then their application is declined. The customer is lost…

Research

Competitive analysis reveals most institutions ask for balance transfer information up front, then prioritize the prospect's requested list by the order they entered it, processing whatever is feasible by the later decided credit limit.

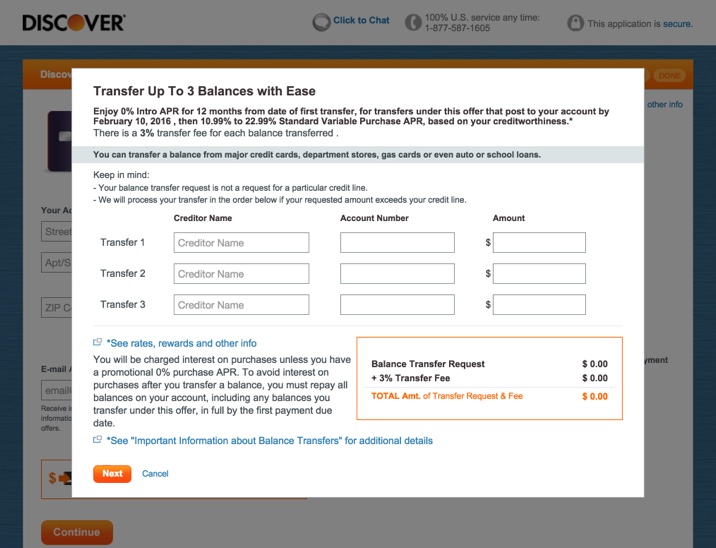

Discover's application reads, "We will process your transfer in the order below if your requested amount exceeds your credit line."

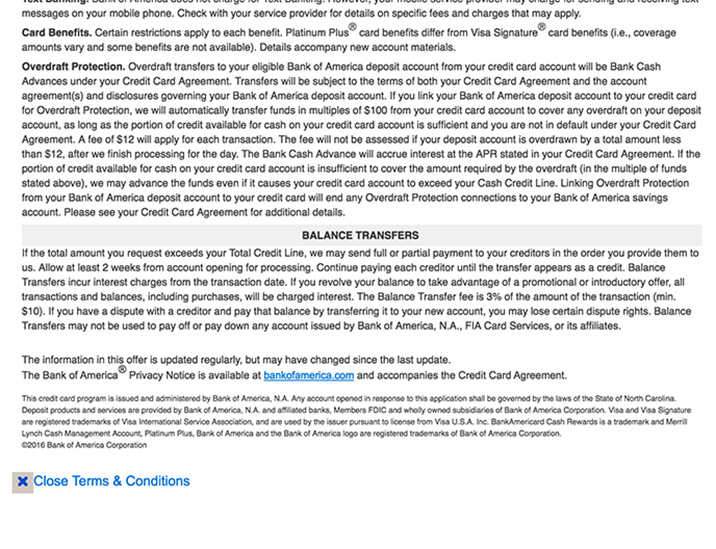

Bank of America's Terms & Conditions basically relay the same information to the user, though it is hidden in modal and buried amongst paragraphs of heavy legal text.

More Research

Internal analytics show a majority of new Card Members are not approved for a credit limit of $10,000 or higher, which makes that 75% of credit limit figure significant. Plus the business released a balance transfer decline rate that is externally confidential, but consequential.

And while just over half of users are submitting only one card for balance transfer, Marketing has made it a priority to increase the number of balance transfers a prospect is submitting.

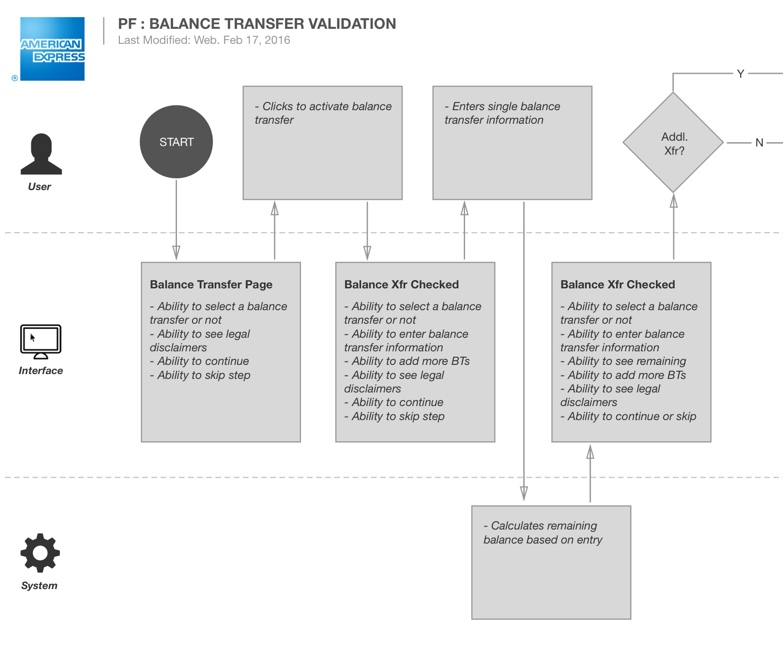

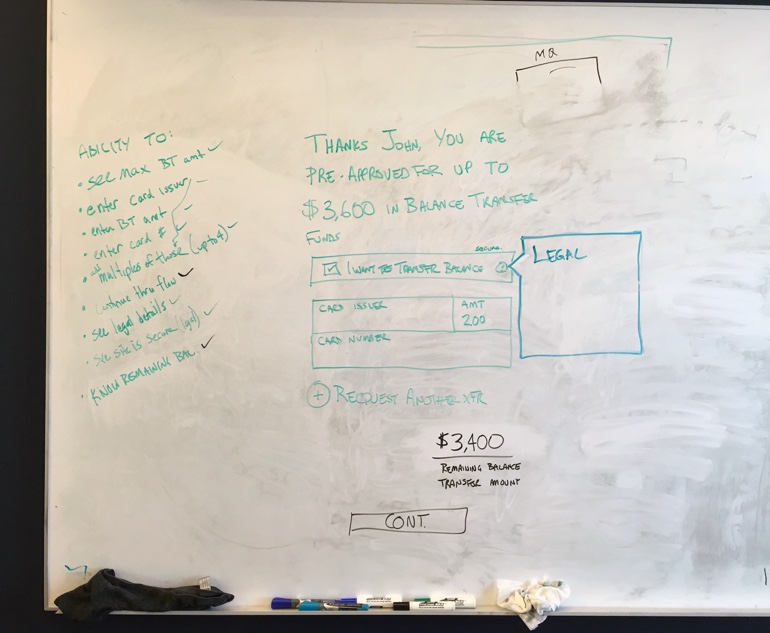

Process

A list of business requirements were drafted by myself and the Product Owner then vetted, edited and adjusted as I met with stakeholders in the Risk, Compliance, Legal and other departments.